Whether you’re a business owner with a few employees, working a traditional 9 to 5 or an entrepreneur, having a retirement plan is crucial.

Here are a few strategies that will help you get in the fast lane to retirement.

1. Define Your Goals- Write out what you would like to accomplish financially in retirement. Such as; increase your wealth through investments, improve your lifestyle, not run out of money.

2. Calculate Your Expenses- You’ll still need to live! It’s smart to list out your expenses such as your living expenses, debt payment, insurance/healthcare, taxes, hobbies/travel and children/grandchildren.

3. Create Your Plan- Determine how many years you have to accomplish your goals. Create your retirement budget that includes income and expenses. Make sure you factor in non-investment income like social security, pensions and real estate holdings. Estimate investment income sources like stock dividends and bonds.

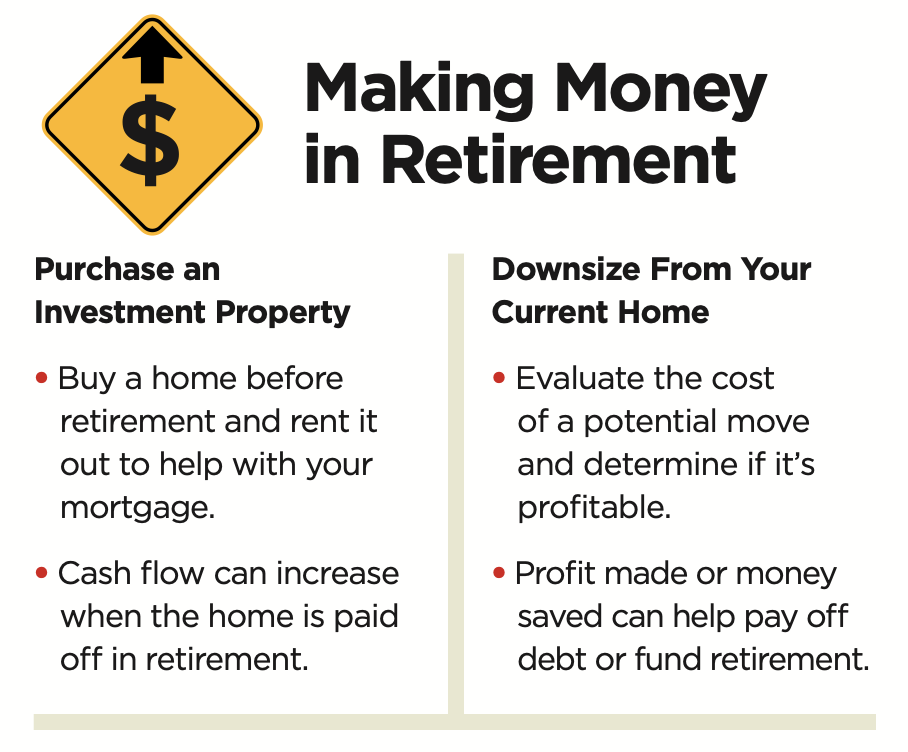

Curious how to make money while in Retirement?

If you need a financial planner to help you sort out retirement, give our office a call and we could give you a great referral!